In accordance with regulations made under the Customs Act (Cap. 82:01), all aircraft or ships arriving in or departing from Guyana, are required to provide advanced information to Customs, detailing the amount of persons and cargo on board the said…

In Accordance with the provisions of Section 39 of Tax Act, Chapter 80:01 the following persons have been issued with Professional Practice Certificates from January to March 2020. GEORGETOWN No. NAMES PROFESSION 1. Abha Jain Medical Practitioner 2. Roopan…

The Guyana Revenue Authority (GRA) wishes to express gratitude to all applicants of the aforementioned programme for showing interest in becoming a partner in the development and administration of Guyana Tax Laws and Legislation. Tandem to the notice inviting applicants,…

The Guyana Revenue Authority (GRA) has finalised the Simplified Declaration (IMS4) Regime which replaces the current C73/ Simplified Declaration Procedure. All relevant training were conducted to facilitate consolidators in the preparation of the simplified declarations which will be utilised for…

Effective Monday, June 1, 2020 the general public is encouraged to utilise the Guyana Post Office Corporation (Robb Street entrance) to make payments for the following services: All Internal Revenue Taxes Customs Duties and Taxes Motor Vehicle Licences Value Added…

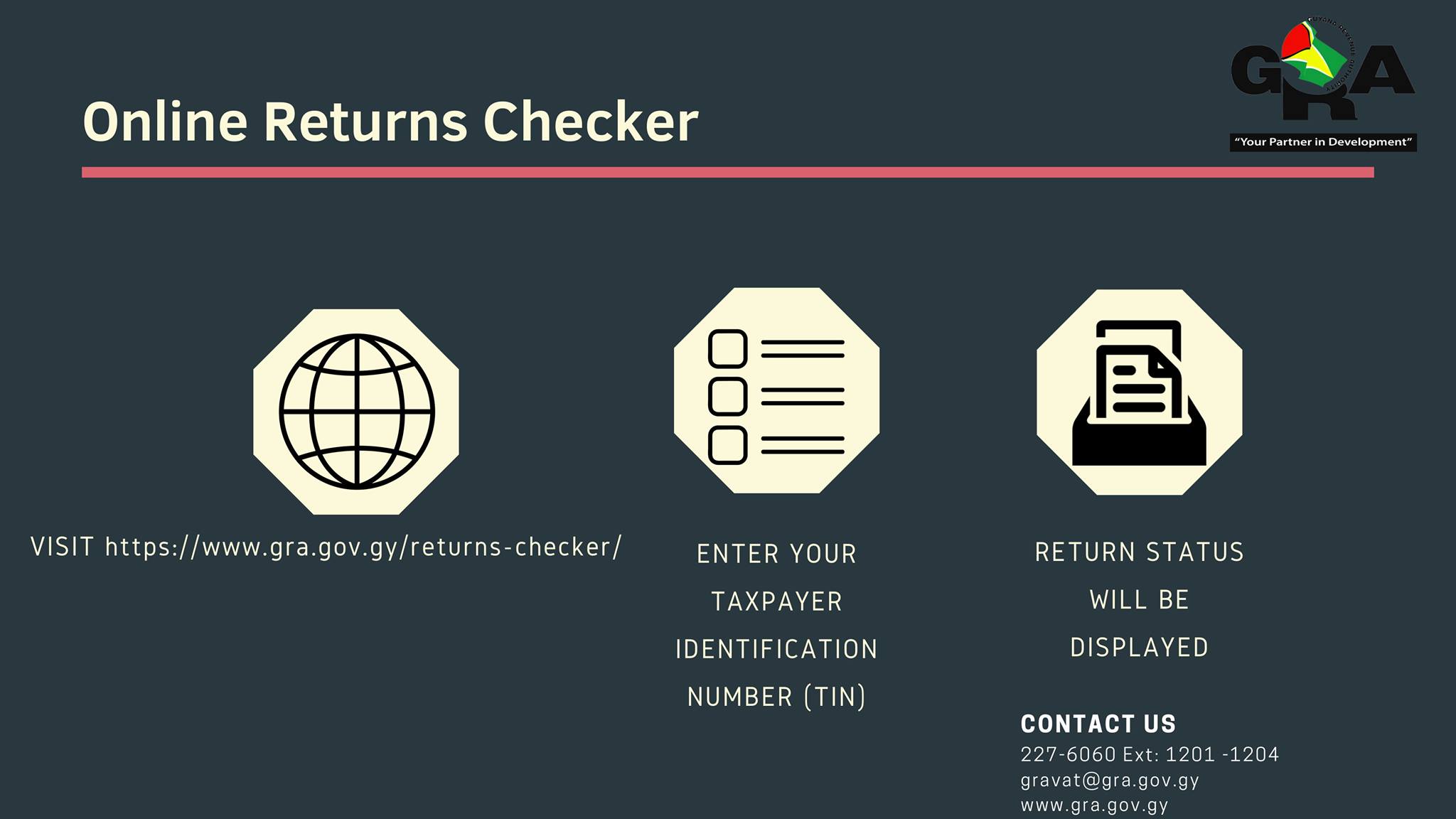

Please be reminded that the deadline to submit Income, Property, Corporation and Capital Gains Tax Returns was extended to June 30, 2020. However, outstanding taxes for the Year of Income 2019 (Year of Assessment 2020) was due April 30, 2020. Taxpayers…

The general public is hereby notified that the exemption of Value Added Tax (VAT) on electricity as a COVID-19 relief measure will be implemented by the Guyana Power & Light Inc. as follows: Pre-paid consumers: There will be an immediate…

The Guyana Revenue Authority (GRA) wishes to advise businesses and companies that Value Added Tax (VAT) & Pay As You Earn (PAYE) Returns can be submitted electronically using the eservices link https://eservices.gra.gov.gy VAT taxes and Returns are due on March…

Resulting from the COVID-19 pandemic, certain measures were implemented by the Guyana Revenue Authority, including the suspension of the sale of licences. Now that the April 30 deadline has elapsed, the general public is hereby notified that the Authority has…

The Guyana Revenue Authority (GRA) has introduced the pre-payment functionality in ASYCUDA World for all Export Declarations in an effort to minimize and safeguard against the current spread of COVID-19. With immediate effect, the GRA is urging all frequent Exporters…