Introduction to e-Services

In 2018, the GRA launched the first phase of its eServices. The GRA is moving towards increasing the use of technology to improve taxpayers’ overall experience when interacting with the GRA. This first phase allows taxpayers to file a few Returns and provides a facility for taxpayers to request refunds and compliances. For this tax season, we are progressively adding new Returns – at the moment, an individual can file his/her Income Tax and an employer can file their yearly and monthly PAYE return while an individual or company can file their Property Tax and VAT Returns.

e-Services Advisory

Uppercase characters, spaces or special characters such as period (.), underscore(_), hyphen (-) and plus sign (+) etc, are not acceptable when creating the username for login to eServices and also in the email address being used to sign up for the service.

1. Requirements for Signing Up

– TIN

– Scanned copies of one of the following. Please ensure these images are clear and readable.

a. Individuals:

– active National Identification Card;

– identity page of active Passport;

– active Driver’s Licence Card

b. Companies:

– active Business Registration Certificate

– one of the identification documents for the representative Individual (listed above)

c. Tax Agent:

– active Tax Practice Certificate (Professional Certificate)

– one of the identification documents for the representative Individual (listed above)

2. Signing Up for e-Service

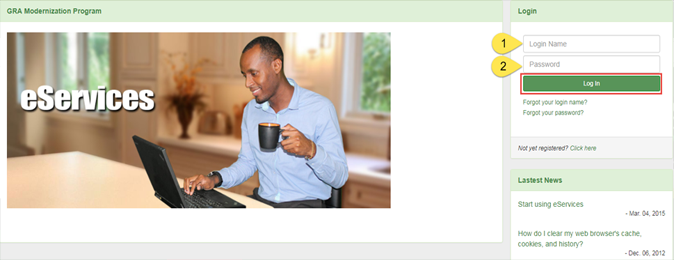

2.1 Accessing GRA eService site (Please ensure you use Chrome or Firefox Browsers)

Visit our website http://www.gra.gov.gy and click the eServices button to access the site or visit our eServices site directly via this url: https://eservices.gra.gov.gy/ .

2.2 Requesting Enrolment

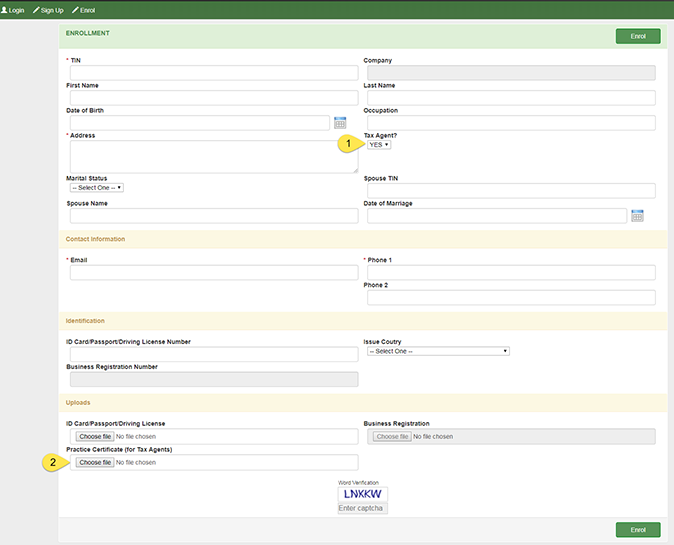

Click on the Enrol button.

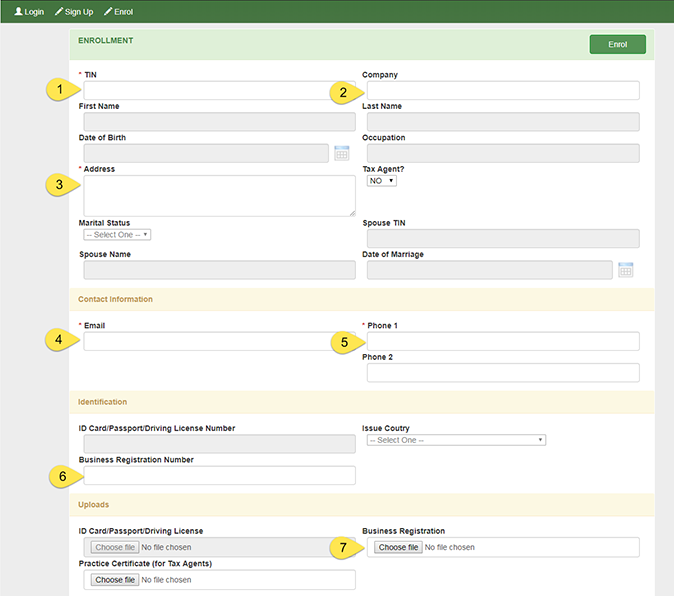

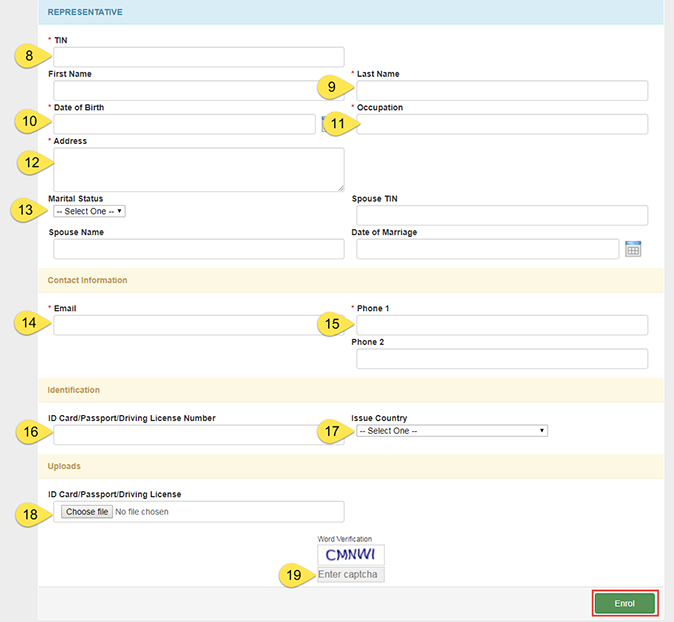

a. Company

1. Fill in all the required information and upload the scanned copies of the identification documents as outlined in the requirements above.

2. Enter the captcha (number 19 in image below) and click on Enrol.

Note: The representative must be one of the parties listed on the Business Registration Certificate or Company documents.

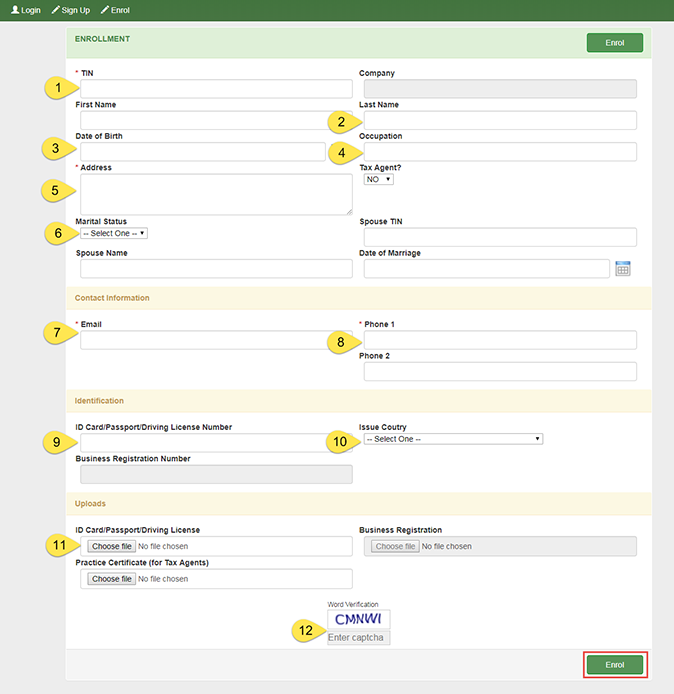

b. Individual

1. Fill in all the required information and upload the scanned copies of the identification documents as outlined in the requirements above.

2. Enter the captcha (number 12 in image below) and click on Enrol.

c. Tax Agent

Note: If you are a tax agent, you need to indicate accordingly and upload your most recent Tax Practice Certificate

2.3 Registering

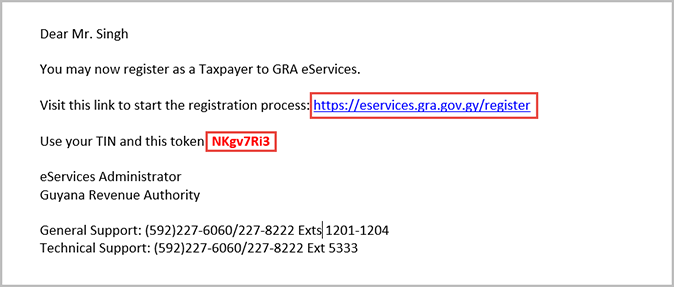

1. After you enrol, the GRA will vet your request. If there is any discrepancy, the GRA will contact you via email or phone for clarification and any further action that may be required. Once there is no discrepancy you will receive a verification token via email.

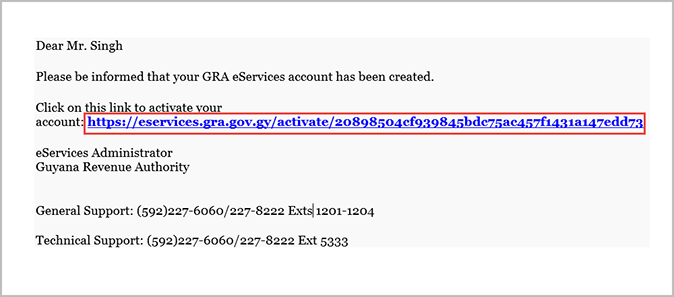

2. Click on the URL provided in your email.

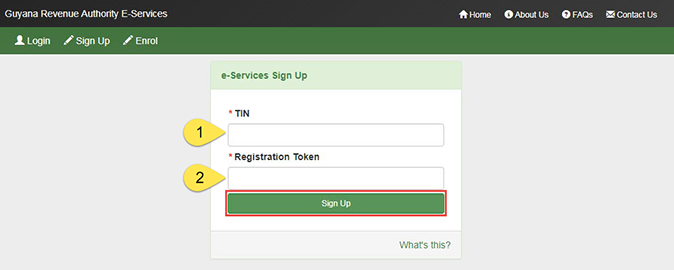

3. The following page will open in your browser. Enter your TIN and the token provided in your email.

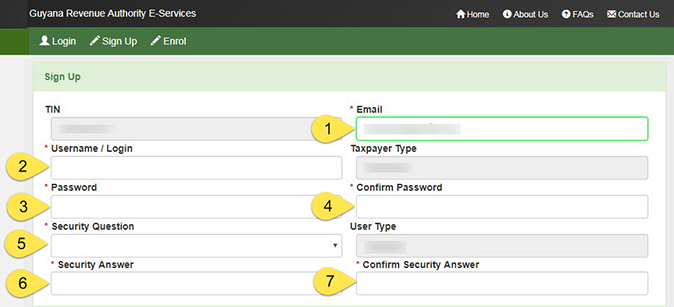

4. Click the sign up button

5. Enter a username and password. Select a security question and enter an appropriate answer. These are critical to maintain integrity of your account.Do not share these with anyone. It is important that you memorise your username, password, security question and answer as these are necessary each time you use the eService.The username and password are case sensitive. It is recommended that spaces are not used in your username.

6. Only enter numbers in the Contact Number field – do not use any dashes or other characters.

7. Enter the captcha (number 3 in image below) and click on Register.

Activation

You will receive an activation email. Click on the URL and proceed to login to your eServices account.

3. Filing a Return

1. Login to your eServices account with your username and password.

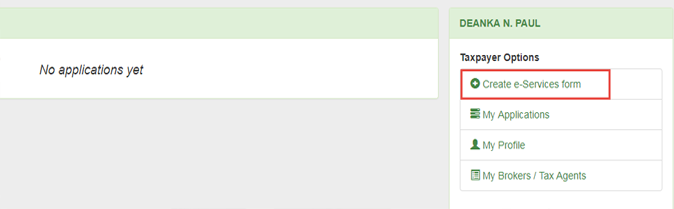

2. Click on Create e-Services Form under Taxpayer Options

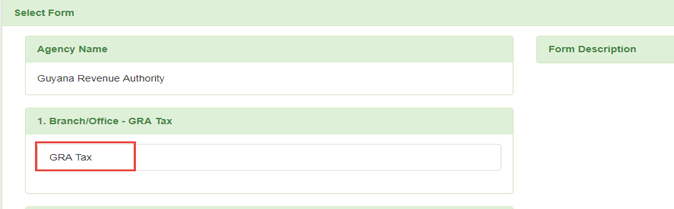

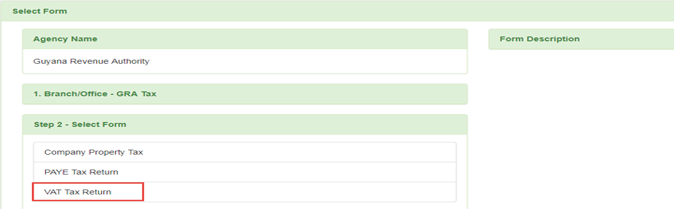

3. Under Branch/Office – GRA Tax, click on GRA Tax

4. Under Step 2 – Select Form, select which Tax Type you are going to file a Return for.

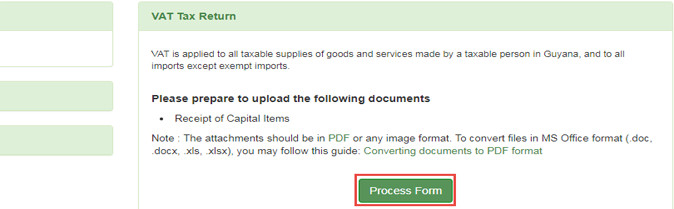

5. Click on the Process Form button, and proceed to fill in the Return.

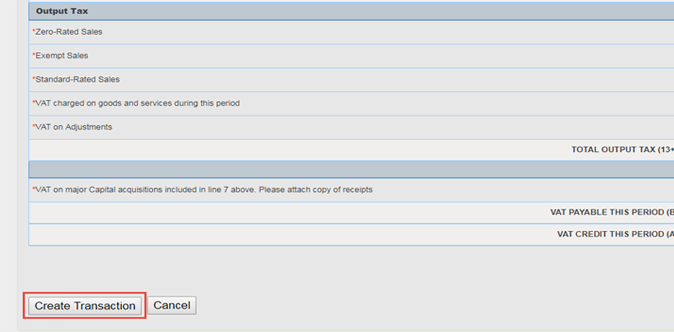

6. Click on Create Transaction after filling in all the required information.

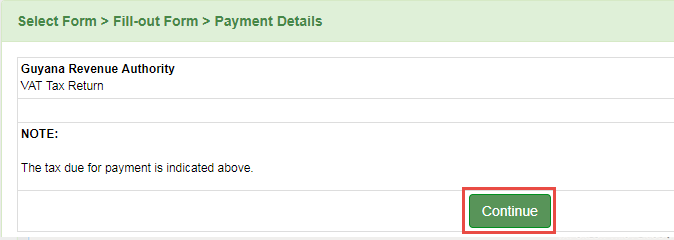

7. Click Continue at the Payment Details page.

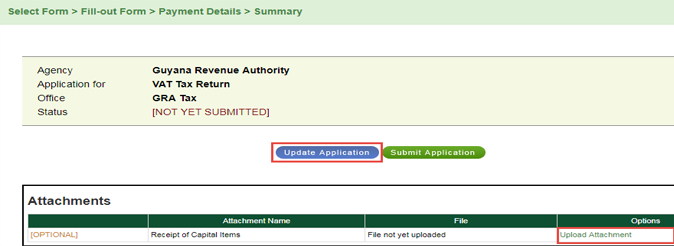

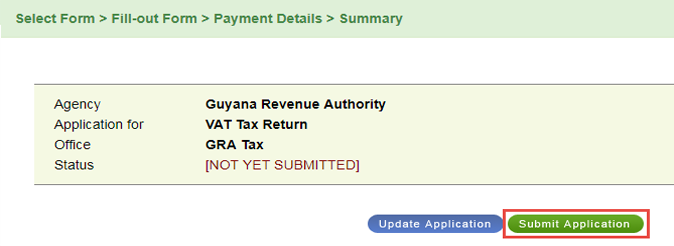

8. On the Summary page, upload any required documents. Review the Return. If any changes are required, click on Update Application.

9. Once all the information is correct and the necessary documents are uploaded and then click on Submit Application. At this point, the Return is submitted to the GRA and is deemed Lodged. You will receive an email acknowledging receipt of your Return.

4. Need Help

If you need general information or clarification about eServices, please contact us on (592) 227-6060/227-8222 Exts 1201-1204

If you need help with the Enrolment or Sign Up process, please contact us on (592) 227-6060/227-8222 Ext 1035